Despite ongoing geopolitical uncertainty and concerns over trade tariffs, broad market averages moved higher over the past three months.

Market Summary

Over the past 3 months, stocks continued their advance and added to gains banked in the first half of 2024. As we had written and observed in our prior reports, the level of gains have been very unevenly distributed between various market segments.

Large cap stocks of the S&P 500 Index rose 2.39% in the fourth quarter of 2024. Despite some choppiness intra-quarter, larger cap/technology driven/expensive stocks carried the S&P 500 Index to a whopping return of +25.0% for the year.

Smaller stocks of the Russell 2000 Index lagged for the final quarter and were left with much smaller gains for the full year. Climbing a mere +0.3% for the trailing 3 months, the Russell 2000 Index ended 2025 with a gain of +11.5% for the full year. Small stocks stood at less than half the return of larger stock peers – an enormous gap. International stocks represented by the EAFE Index continued to struggle and fell -8.1% in the final 3 months of 2025, and stood even farther behind the S&P 500 for the year with a gain of +4.4%.

Diversification was also a big loser. Betting it all on black is not a great investment strategy; many of us should agree. But there are times when unbalanced concentration is the best performing approach in the casino, maybe even for 4 or 5 spins in a row. Just 26 stocks now account for one half of the S&P 500 Index’s value. We see diversification as a central tenet to making sure our clients avoid unnecessary levels of risk and as a vital component towards successful investment policy execution. International investing, mid/small cap stocks, fixed income – most anything that wasn’t large cap technology dominant performed relatively poorly. While missing out on the excess returns of a narrowly loved and chosen few of today, we have faith in the prudence and ultimately smoother pathway of diversification.

Aurora Perspective

Successful long-term equity investing in a lot of ways comes down to providing patient capital and allowing for companies to increase their profits, while waiting for the stock market to correct valuation mispricings. We shareholders rent the stocks in the meantime, and get compensated for our time and short term risk with long term appreciation.

Some facts about the US stock market in 2024 to consider:

- Large Stocks beat Small Stocks by over 14 percentage points in 2024.

- Growth Stocks beat Value Stocks – Russell 1000 Growth Index beat the Russell 1000 Value Index by over 20%.

- US Stocks beat International Stocks – The S&P 500 Index beat the EAFE Index by over 20%.

- The Russell 2000 Index since June of 2021 is break even at 0.0% return for the past 3.5 years.

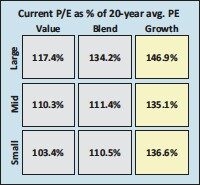

Differences and preferences between certain styles of stocks and investment approaches tend to balance out over time. On the next page, we will detail some recent trends, and consider how any reversion to fundamental norms may prevail going forward.

There are some fundamental truths and tenets that hold over the short-term ebbs and flows of market cycles. Valuations don’t grow to the sky forever, economic and political influences follow cycles, and exuberance over new approaches (think internet, leverage/borrowing, artificial intelligence, etc.) finds relative balance over time.

Aurora Outlook

As mentioned in our preamble, we have been applying our Growth At a Reasonable Price (GARP) discipline for over three decades at this point. While we have no doubt that the future will remain uncertain, and that surprises are present on every corner, there is also always an echo of the past and a return towards rational norms. Aurora’s returns in past market corrections have proven very favorable in the unwinding of past imbalances and market excesses. Aurora’s returns over longer time periods likewise have rewarded committed discipline and steady focus on the growing profits of the companies we invest with.

Aurora’s long-term returns and record of navigating countless cycles and travails have shown clients the benefits of consistent and patient adherence to sound fundamental investment principles. Thank you to our clients – we truly appreciate the faith and support provided as we look towards the next decades of opportunity and service.