The US stock market began the year 2025 precariously – with high volatility and ultimately negative returns for the first three months. While new government agendas and fiscal policies are being unrolled and the economy at large adjusts, there was not much change in corporate earnings reports as yet.

Market Summary

Market returns for the first half of 2024 have been resilient and, in certain segments, quite strong. While absolute returns for equity markets have been fulfilling and ample reward for the short term volatility, there are troublesome echos that indicate potential concern for the future. Below we will detail these concerns and offer our perspective and investment positioning.

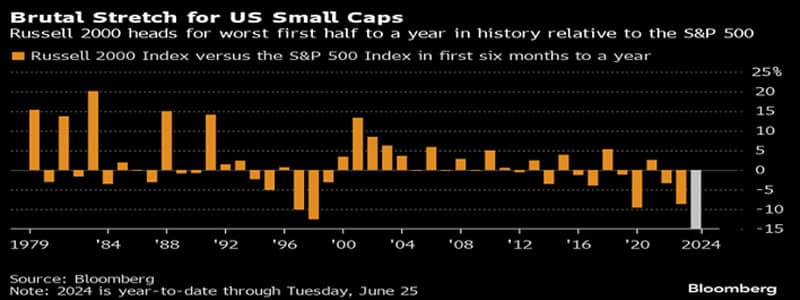

The large stocks of the S&P 500 Index rose a sturdy +4.2% for the second quarter, and stood at a remarkable +15.2% for the Year To Date. Most other market measures that aren’t dominated by the hyped up Artificial Intelligence stocks or other high tech holdings did not fare anywhere near as well. The smaller stocks of the Russell 2000 Index for example, fell -3.3% in the last 3 months, and posted a weaker +1.7% return for 2024 thus far. International stocks broke even in the second quarter at -.1%, and while positive at +5.8% YTD, stood miles behind the S&P 500.

Aurora Perspective

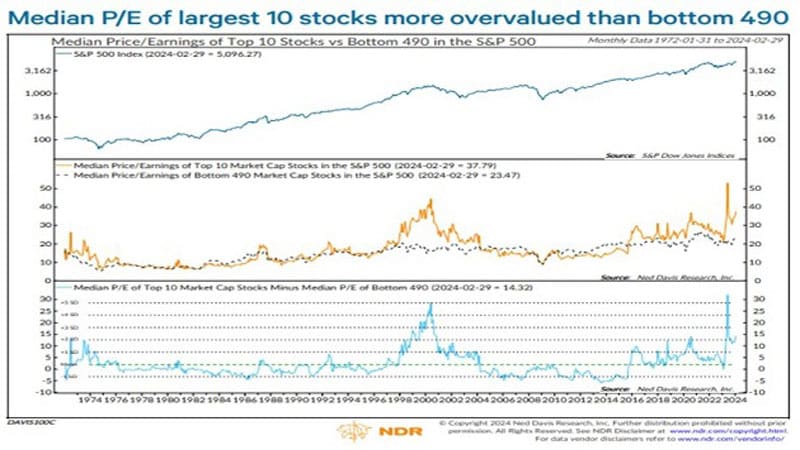

The yawning gap in returns between the elite S&P 500 Index is historic. While it is common throughout market history for certain types of stocks and concentrated sectors to out/under- perform, the level of exuberance afforded to the S&P 500 in recent months is anomalous. Particularly when considering the large amounts of capital deployed into such passive index products, and with the understanding of increasingly narrow weightings towards a relative few stocks and sectors – there is a self fulfilling prophecy that has led to these distant return comparisons. As the FAANG stocks perform well, more passive investor money gets applied, which generates more concentration, and so forth…

As stated, it is relatively common for this phenomenon to be present in market returns. The extent, and the awesome amounts of capital following this pattern is what is reaching historic levels and the cause for our concerns. Passive index investing is a perfectly viable and rational approach. Combined with the convenience of index products for individual investors (think 401K’s) and implied diversification of 500 leading companies behind it – passive investing can appear to be the “safe” choice. Lets examine the other side of the coin with some history.

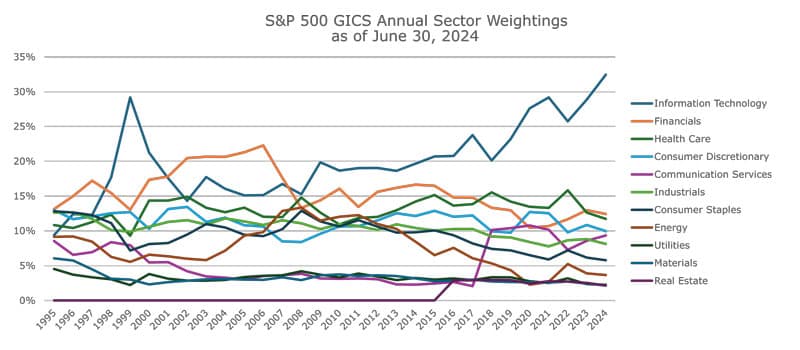

In what appears to us as an echo pattern for today, the Technology Sector of the S&P 500 Index has had an average weighting of roughly 15%. At times it would ebb and flow, but in the inflating of the Internet bubble in the years 1999 and 2000, the Technology Sector weighting rose to be 29%. By the peak of the Tech bubble in March 2000, the Technology sector’s weighting had risen to 34.81%! For those of us who remember this period, the novel Amazon and stalwart Cisco Systems and other representative stocks had only the rosiest of futures ahead, and their stock prices appreciated at dizzying rates to stratospheric and unsustainable levels. Far from being diversified – the Index had become dominated by such high priced fare. In the unwinding of this position and time, Technology stocks plummeted both with individual stocks failing, but also the Technology Sector losing its weighting back to more normal levels.

Similarly, in the heady days leading up to 2007, Financial Sector stocks were in fashion. Mortgage lending and financial engineering led to appreciation in stocks participating in this area which afforded much investor attention. Historically the Financial Sector represented a typical 16% weighting in the S&P 500 Index. By September 2006, the Financial sector’s weighting had ballooned up to 22.35%. With rosy forecasts in this era, such stocks appreciated to represent a disproportionate weighting in the S&P 500 at the end of 2007. In the subsequent cratering of these companies and reversal of investor support, the whole market suffered sharp pains and the Financial Sector weighting returned to average levels again. From the end of 2006 through the low on March 9th, 2009, the Financial sector’s weighting in the S&P dropped from 22.27% to 8.58%.

The point of this historical walk isn’t specifically to forecast positive or negative on any market sector at any one time. Aurora Investment Counsel understands that diversification is a necessary tool to maintain a risk-balanced approach for our clients. It appears that many passive investors in Indices such as the S&P 500 may believe that their approach represents a balanced, safe approach. In our view, the returns of recent days and the dramatic shift into relatively few high tech stocks and the Tech sector in general does not represent such balance. The 30% weighting of the Technology Sector currently may be argued as dangerous and inconsistent with a balanced investment posture.

Aurora Outlook

In summary, we acknowledge the heady positive returns the S&P 500 Index in particular has offered. While Aurora’s GARP investment discipline has been over long periods competitive and in our view risk efficient – we have not kept up in this recent anomalous period. In considering how to best match our clients’ long term Investment Policy objectives, we are inclined not to copy the Technology Sector weighting and dominance of the S&P 500 Index of today. We believe that the risk of such concentration, and the hyped up valuations of these certain stocks is inconsistent with our investment discipline and the mandates our clients have given us.

Time will tell if history is to repeat or if the echos will yield a different outcome. Regardless, the absolute returns Aurora’s clients are earning at present are positive and consistent with building wealth towards long term financial growth goals. Our discipline and history indicate a lower risk approach and balance that allows for prudent appreciation potential and long term success.