Despite ongoing geopolitical uncertainty and concerns over trade tariffs, broad market averages moved higher over the past three months.

Market Summary

Stock market averages raced higher to end the final 3 months of the year at a high point. There were real moments of weakness within the quarter and the year, as many stock measures were in negative territory for meaningful periods of time.

The S&P 500 Index of large companies rose 11.7% in the 4th quarter, and displayed a very strong +26.2% annual result. There is important context to be added to the “average” result here, but in any event this represents a positive year for the leading stock market measure. The smaller stocks represented by the Russell 2000 Index had trailed the larger peers for much of the year. The final tally reflects this with the Russell 2000 Index landing at +16.9% for the Year To Date, after a strong final three month climb of + 14.0%. International stocks of the EAFE Index also participated well, with a +10.4% climb in the quarter, and a

+18.9% rise for the YTD.

A further note to summarize stock market returns; the positive results of this year can also be overlayed with the negative annual results of 2022. While perhaps not forgotten, we have been enduring a higher level of short term swings as stock prices eventually follow corporate profit growth. With 2022 having delivered sharply negative returns, the 2-year return of our referenced averages is in the table below.

| 2-Year Return (1/2022-12/2023) | 2023 Return | 2022 Return | 5-Year Return (Annualized) (1/2018-12/2023) | |

|---|---|---|---|---|

| S&P 500 Index | +3.3% | +26.2% | -18.1% | +13.4% |

| Russell 2000 Index | -7.0% | +16.9% | -20.3% | +8.5% |

| EAFE Index | +2.4% | +18.9% | -13.3% | +6.7% |

Chart Source: Bloomberg. Index returns with fees, future returns are not guaranteed

While volatile, and at times concerning, the year end rally was refreshing to long term investors. The ups and downs of short term stock price movements can be concerning, especially with the cacophony of external news on the economy, politics and such. Heading into an election year with vitriol already in the chamber, and with fraying economic signs and higher valuations – risk and volatility remain a psychological wall of worry heading into the New Year.

Aurora Perspective

Aurora is a disciplined Growth At a Reasonable Price (GARP) investment manager. As such, we frequently start our prospective look into a new year through these lenses – the price of stocks and the rates of growth.

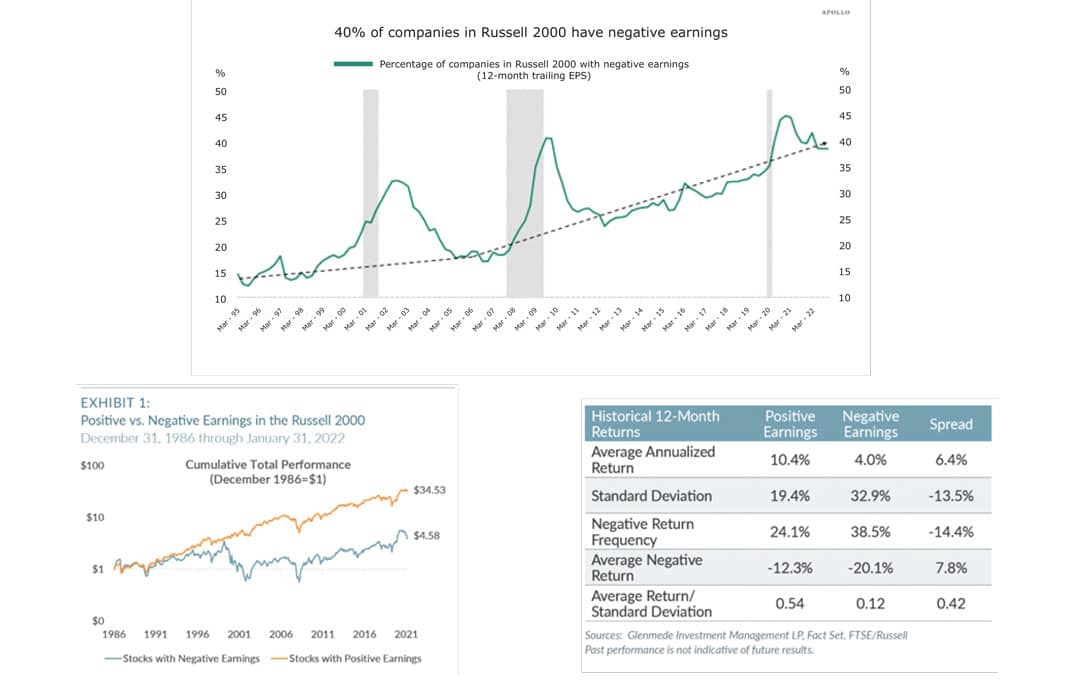

With regards to the valuation of stocks (the price of a stock compared to earnings and cash flow), there is a bifurcation that may represent opportunity. Stocks are expensive, on average, and this represents risk and can indicate a hurdle for the market. However, when looking past the narrow few stocks that have lead the overall average higher, many stocks are cheap and we would argue less risky. The flip side of expensive market leaders is the potential for overlooked bargains elsewhere.

The earnings growth part of the equation is likewise muddled. While Aurora is able to be selective and restrict our holdings to companies built on visible and sustainable financial strength, the environment for the broad economy is mixed. Consumer demand seems favorable, individuals seem to be not overly financially stressed with a strong labor market. Corporate financial health is decidedly mixed – there are many companies that have solid balance sheets, and many companies with positive profits and growth. Government stimulus has been a prop (representing roughly +4% of GDP last year), and likely will be a growth detractor (-1.5% forecast) for 2024.

There are also a high proportion of companies that have short term borrowings maturing in the near term that will likely involve significantly higher interest rate costs. Some of these companies are also currently unprofitable and not able to self-sustain their operations without added capital. These companies seem highly at risk if the economic winds turn towards recession.

Aurora Perspective

While it seems intuitive, negative profits and high borrowings are not sustainable. Small companies and startups can often begin operations in this posture, or pursue a period of “investment” to achieve future growth and change. This is NOT the type of growth investing Aurora pursues – and discriminating between growing and profitable companies has helped us avoid the unattractive stock returns associated with this dynamic.

The flip side to this equation is that there are increasing numbers of cheap and profitable stocks elsewhere. By remaining focused on our Growth At a Reasonable Price (GARP) discipline and avoiding the higher leveraged companies exposed to higher interest rates, we gather some confidence that appreciation opportunities remain at an acceptable level of risk. Despite our wariness described above, we are finding solid growing companies at cheap valuations – giving us confidence in these stocks’ ability to deliver adequate returns.

Aurora Outlook

Warren Buffet once said that “Growth is part of the value equation.” We agree, and have tried to give some perspective on the current landscape for long term equity investors to consider. In the end, we believe that correctly maintaining a diversified and steady Investment Policy focused on your personal goals and dynamics is the way to success. There isn’t much in the current situation that shakes our confidence in Aurora’s ability and discipline to continue to meet the needs of our investment clients.