Despite ongoing geopolitical uncertainty and concerns over trade tariffs, broad market averages moved higher over the past three months.

Market Summary

The fourth and final quarter of 2022 presented a recovery and reversal of the earlier broad market declines. Stock prices in the US and abroad generally moved higher in the preceding 3 months, despite wobbling lower just before year-end.

The stocks of large companies in the S&P 500 Index rose +7.5% in the last quarter, and finished the year with a -18.1% decline. This decline confirms our 2022 exit firmly in “bear market territory”, despite sputtering attempts for stock prices to recover. The smaller stocks measured in the Russell 2000 Index lost -20.5% for the Year To Date, while climbing a more meager +6.2% in the last 3 months of the year. A bright note in equity markets was the recent performance of foreign equities, where the EAFE Index surged +17% in the last quarter alone, albeit retaining a -14% loss for the twelve month tally.

As noted in our last letter, interest rates have risen substantially as well. There is an economic impact to be felt everywhere from homeowners to consumers to corporate borrowing costs when rates rise. There is also a direct negative affect on bond prices when rates rise. Without considering the deleterious effect of a recession on credit risk, rising rates mean lower bond prices for investors. The holder of a 30 Year US Treasury bond saw a -12% decline in value.

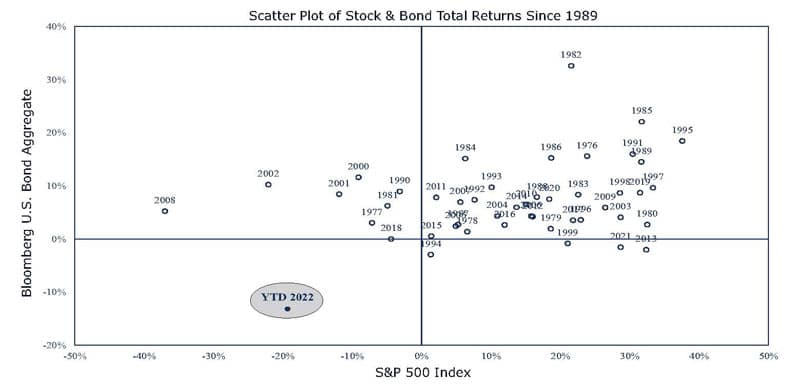

There have been very few places to hide from the weakness and declining confidence in financial markets over the past year. The chart above highlights this past year’s pain compared to the prior 45 years.

Aurora Perspective

Also continuing from our last report, we noted opportunities to hopefully buy quality growth companies at reasonable prices. The metaphor of “buying Ferraris at Ford prices” depicts our view that we have been able to upgrade the quality and consistency of earnings growth in our invested companies, while still being disciplined about the valuation of such stocks. We noted that there typically is a “human” or “emotional” component to such broad financial market weakness, and it seems as though the most fearsome elements of investor psychology are dissipating.

Aurora’s primary focus is on our Growth At a Reasonable Price (GARP) discipline, and not on discerning market timing opportunities or distilling economic forecasts. It is necessary to gauge the winds of change economically, and at some point there is consideration given to the impact on corporate earnings of these external factors. Yawning government deficits, currency movements, commodity prices/inflation and rising geo-political instability are all problematic concerns that can have bearing on any individual company’s ability to navigate towards profitable growth.

Recent updates and statistics show these influences leading to higher measured inflation, as well as recessionary readings on both the US economy and that of most other countries. Aurora’s macro view is that the worst of the consequences for such problems has likely been discounted in current stock prices. We don’t see reversals and recovery present just yet, but the lowered prices and the green shoots of improvements leave us more sanguine about the next 1-to-3 year opportunity.

Aurora Outlook

The past year has obviously not been comfortable or rewarding. However, Aurora’s GARP discipline has guided our stock selection to avoid the most over-valued areas leading into the recent decline. Our performance this year has resulted in protection and lower loss than most market averages. We remain focused on the sound principles and approach that has given our clients long term rewards and appropriate risk protection.

The short-term outlook for both stock and bond markets remains uncertain and tainted by difficult macro conditions. Looking just a few quarters out allows for the clearing of some of the challenges, and allows for an optimistic path to recovery. By avoiding the harshest declines, and by maintaining investment discipline while investing in growing companies’ progress, we believe adequate long term returns can be harvested. Having been through various cycles in the past, and having navigated challenging markets- the payoff to clients for being committed to an appropriate investment program can be very valuable.